Is this worth doing or not?

Understanding financial metrics used for investment decision making become more important as we try to turn plans into action.

I thought I’d do a quick dive into the methods out there and came across a useful paper by Delapedra-Silva et. al. (2022).

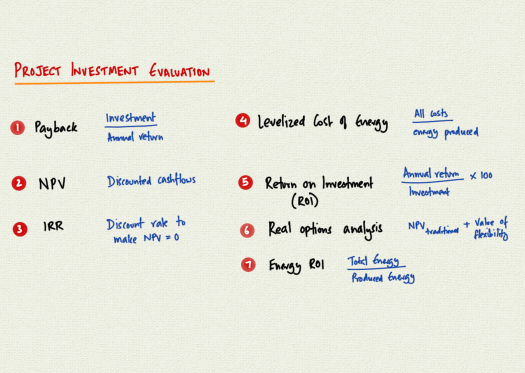

Many businesses use simple or discounted payback as a way to evaluate an investment.

It’s an easy one to calculate – how many years before you get your initial investment back. And that’s why it’s very popular in businesses.

But it doesn’t take the lifetime of returns into account. What if you keep getting a return well after the initial payback period?

That’s where Net Present Value comes in. The value of an investment is the total of the discounted cashflows you get.

So a business in the stockmarket is valued on the basis of what the market thinks it’s going to make in the future.

And then you have the Internal Rate of Return (IRR), which is the discount rate that sets NPV to zero.

If the IRR is 10%, you can compare that to alternative investments, like a bond – and make a call on whether the difference is enough to make up for the risk.

These three are fairly traditional approaches, along with the return on investment (ROI), which is the percentage return you get – the inverse of payback.

These approaches work great in regular businesses but they struggle to make the case for long-lived assets like energy projects – renewables or large scale replacements and refurbishments.

A more useful metric is the levelized cost of energy – the lifetime costs associated with producing energy over the the actual energy produced.

This value, in say pence per kilowatt hour can be compared with the market price to see if you’re going to save money or not.

A closely related metric is the energy ROI, which is the total energy you need over the energy produced – although this isn’t that common.

But even these methods don’t account for the full complexity of the decision.

In the real world, you’ve got to think about timing and flexibility – what happens if you do a project earlier or later, or what happens if the market moves one way or another.

This is where Real Options Analysis comes in, where you start with the NPV, and then layer in the additional value from different kinds of flexibility and uncertainty associated with the operation of a particular project.

All this might seem complicated but it’s more straightforward than it looks – really.

And the biggest benefit comes from thinking this through with your team.

REFERENCES

Delapedra-Silva, V., Ferreira, P., Cunha, J., Kimura, H., 2022. Methods for Financial Assessment of Renewable Energy Projects: A Review. Processes 10, 184.