The US economy is sputtering. This should worry all of us.

There are two big happenings that are affecting markets, one immediate and one longer term.

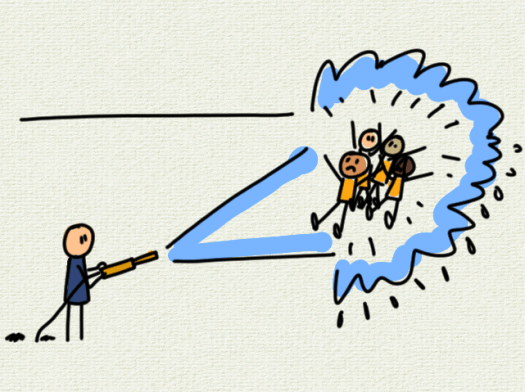

The immediate issue is that the US economy is reeling from a firehose of policy shocks, what some might call erratic decision making, and what looks increasingly like a puncturing technology hype bubble.

People are being affected. The economy is adding fewer jobs than needed for economic growth.

Cooling demand usually has a follow on effect on energy markets, dampening global prices.

The longer-term issue is the rise of the far right, and the resulting economic consequences of power-based politics.

The Economist suggests that by 2027 some of Europe’s most significant economies could have hard right parties in office.

Traditionally such parties implement protective and nationalistic policies – offering tax cuts, competitive protection and handouts.

The result is often stagnation. Populism and poor economic decision making go hand in hand leading inevitably to fiscal crisis.

We can see the early warning signals here in rising bond yields – it shows that markets are starting to price in these risks.

And often, things get worse before they get better.