Battery storage systems are one of the most anticipated technologies in the energy market at the moment. But will they save you money and how do you put together a business case?

These are my notes from a podcast by Barry Cinnamon of Cinnamon Solar from May 2016, along with some additional research and comments. The whole podcast is well worth listening to and you can find it here.

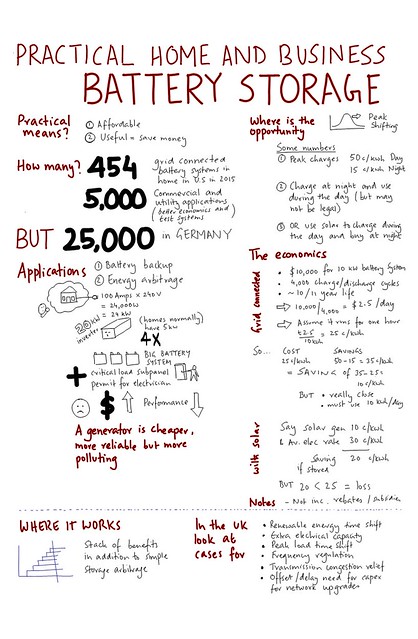

First, what do we mean by practical? A practical system has to first be affordable, and second be useful. Above all, this means it must save you money.

In the United States, there are around 450 battery storage systems in homes and around 5000 commercial installations. Germany, on the other hand, has over 25,000 installed systems.

Policy makes a difference when it comes to battery storage

Energy storage systems are seen as a crucial part of the energy transition happening in Germany (Energiewende).

There are already more than one half million solar installations with a capacity of 40 GW in the country.

It makes sense to add battery storage systems to these installations so you can squeeze the most energy out of them.

Germany Trade and Invest (GTAI), forecasts that 50,000 battery solutions could be installed each year by 2020.

Battery storage will not solve all your problems

Batteries are not a good choice for backup power for a few hours to a few days.

To provide a full supply to a normal house you need a big battery system. It’s much larger than the normal capacity of a grid connected wire.

You also need additional circuitry, permits and contractors to carry out the work.

The system will struggle to give you continuous power for a long time, especially if you lose power for days.

It’s much easier and cheaper to just buy a generator for backup power, but it’s obviously more polluting.

The main opportunity lies in energy arbitrage

People are very excited about battery storage because it will help you store energy where it is cheap and use it when it is more expensive.

But is this really the case?

One easy way to work out the numbers that matter is to think about the lifetime of a battery system. Using the example from the podcast:

It costs $10,000 for a 10kW battery system that has 4,000 charge / discharge cycles.

This means it has a life of around 10 – 11 years if used once a day.

The cost per day of the system is therefore $10,000 / 4,000 = $2.5 per day.

If the system runs for 1 hour and generates 10 kWh of energy, the cost per kWh is $2.5 / 10 = 25 cents per kWh.

Let’s say the cost of electricity from the grid during the day is 50 cents during the day and 15 cents during the night.

So, if you were able to charge the battery at night and then use it to offset expensive power during the day, you have just saved 50 – 15 = 35 cents.

At the same time, putting in the battery system has cost you 25 cents. So, your saving is 35 – 25 = 10 cents.

There is a saving, but it’s marginal and you need to get everything right.

What happens when you put a battery storage system into a solar PV installation?

This does not automatically make you money – unfortunately…

If the saving from your solar generation is less than 25 c/kWh, then you will lose money by adding a battery system that costs 25 c/kWh into your installation.

This excludes any rebates or subsidies that apply, and just looks at a straight business case.

How can you make the business case work in the UK?

The secret is getting your stack of benefits right in addition to simple storage arbitrage?

In the UK, successful projects have used many of these schemes and opportunities:

- Renewable energy direct time shift

- Peak load time shift

- Extra electrical capacity

- Transmission congestion relief

- Relief from the capex needed for network upgrades

- Frequency Regulation

- Voltage regulation.

In Q3, 2016, National Grid bought around 200 MW of frequency response services, mainly through battery systems. Their balancing services page is a good place to start if you want more information.

Summary and conclusion

In summary – you can make money by putting in batteries, but it’s not going to be as easy as you hoped.

It’s important to understand the different ways in which the cost of power stacks up in your country and what this means for the savings you can make.

For the UK in particular, schemes change all the time. That means you cannot guarantee your savings and need to create a business case can handle this.

One way is to introduce probabilities into your model and work out the “expected value”, and “confidence level” of the schemes.

Doing this means you can say that you are 95% confident of achieving a saving of X.

This can help you build an overall business case so you know how much you could make.

The next challenge is getting your funders to sign off on the project…